All together now: Costs really matter.

The late, great Jack Bogle – the founder of Vanguard and the grandfather of index investing – left us all with a simple mantra that he repeated almost every time he wrote an article or gave an interview: “Costs matter”. He also often used to say, “In investing you get what you don’t pay for”. And therein lies the rub.

In day-to-day life, we tend to assume – largely correctly – that you get what you pay for. If you need a good lawyer, it’ll probably cost you. If you want the paint to last on your walls, employ a decorator who costs more because they’ll spend more time prepping the surfaces and use better quality products. Buy cheap, buy twice! Yet when it comes to investing, broadly speaking, the exact opposite can apply.

Are you getting what you pay for?

The more you pay to service a fund, the less you’ll get in your pocket at the end of the day. As well as ongoing charges to invest, there are costs associated with owning the fund over time – such as those incurred when buying or selling shares – that eat into your returns.

It would be easy if all you had to do to select a good fund was to pick the most expensive manager… but we know that’s not the case. Over 85% of all US equity funds failed to beat the market over 20 years, not least because of the high costs they incur, some of which could set you back significantly more than 1% a year.

What about if you reverse your strategy and pick the cheapest fund? Perhaps surprisingly, this tactic is likely (although never guaranteed) to be a better option.

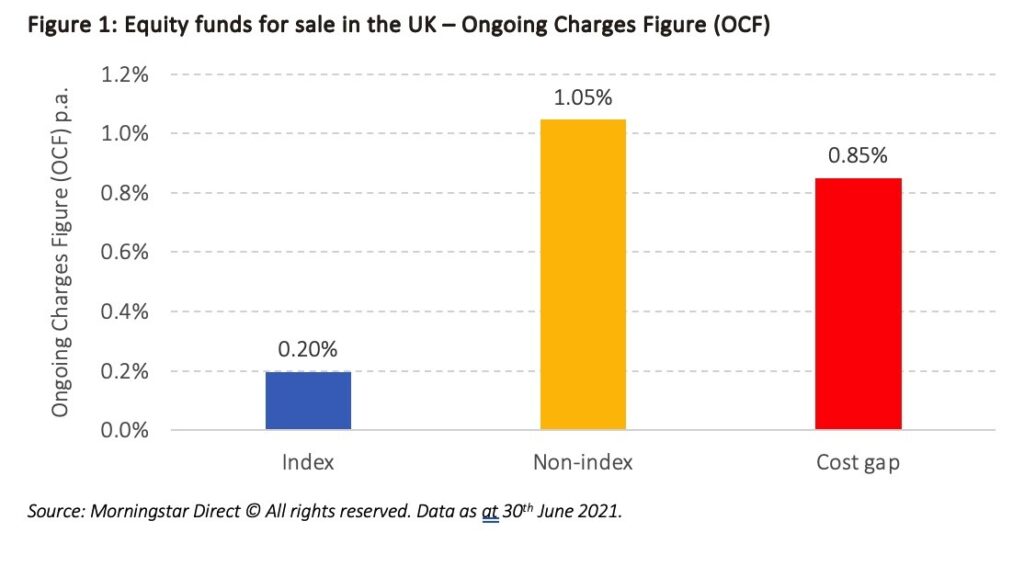

Here’s a snapshot of funds available for sale in the UK – both index funds delivering the market return (295 in all), and non-index funds (4,969) seeking to beat the market return.

[Figure 1: Equity funds for sale in the UK – Ongoing Charges Figure (OCF) Source: Morningstar Direct © All rights reserved. Data as at 30th June 2021]

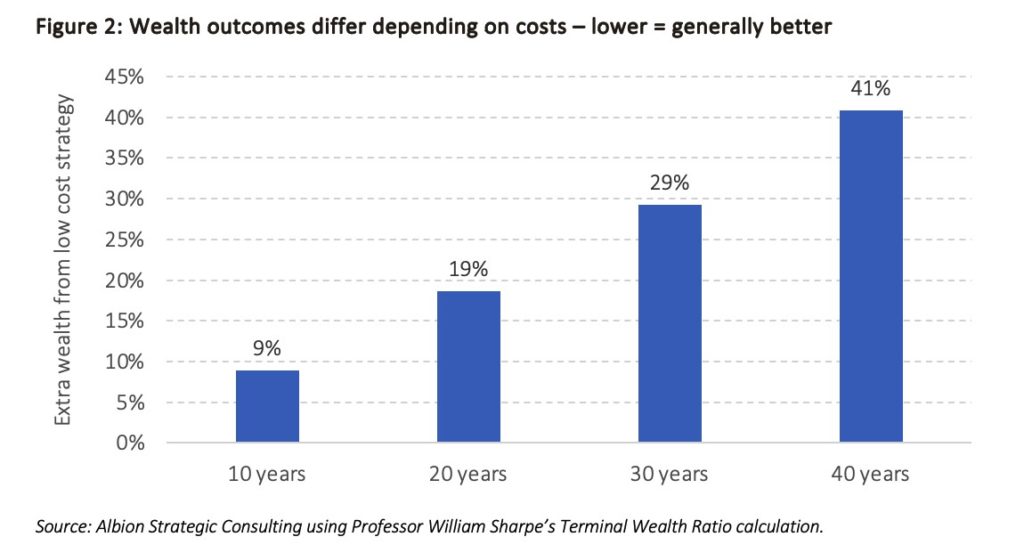

The chart below shows you how much more money you would have with the lower cost strategy over different timeframes.

[Figure 2: Wealth outcomes differ depending on costs – lower = generally better Source: Albion Strategic Consulting using Professor William Sharpe’s Terminal Wealth Ratio calculation.]

Put another way, at the end of 40 years – not an unreasonable investing horizon – if the high-cost strategy ended up with £1 million, the lower cost strategy would have £410,000 more to spend, all else being equal.

The privilege of spending less

Perhaps we should also take heed of another investing titan, Warren Buffet, who reflects on the trouble the wealthy sometimes have in buying something cheap, in this case index funds:

‘The financial “elites” – wealthy individuals, pension funds, college endowments and the like – have great trouble meekly signing up for a financial product or service that is available as well to people investing only a few thousand dollars. This reluctance of the rich normally prevails even though the product at issue is – on an expectancy basis – clearly the best choice.’

Warren Buffett (2016) Berkshire Hathaway Shareholder Letter

As investors we shouldn’t lose sight of the fact that we put up 100% of the capital and take 100% of the risk of doing so. Surely, we deserve to pocket the bulk of the returns on offer. So, all together now, one last time, “costs really matter!”

…………………

This blog was adapted from an article from one of our partners, Albion Strategic Consulting, with their permission.

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Categories: Investments