Successful wealth management involves long-term planning from the very start. As a parent or grandparent you want to help the next generation and this note sets out a straightforward, highly tax efficient way you can do this while maximising tax allowances and credits.

‘Help reset the inter-generational imbalance – what better gift for the next generation?’

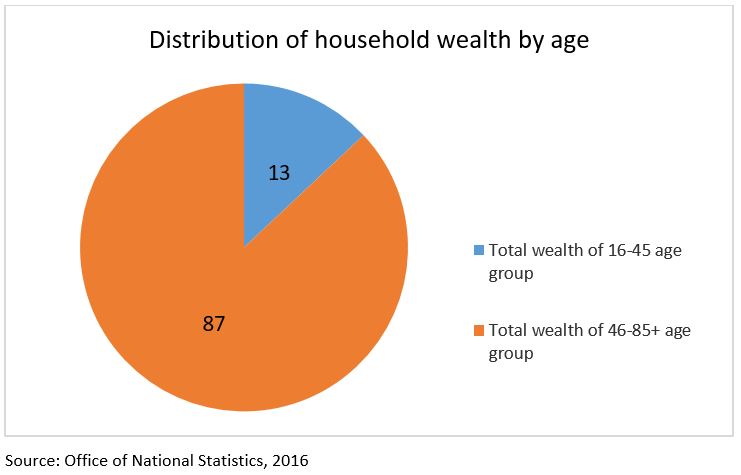

The imbalance of wealth between the generations and the difficulties the younger generation and children may face in the future are well known. The chart below illustrates the point. In aggregate terms the under 45’s own just 13% of total wealth, whilst the over 45’s own 87% of total wealth.

The position is mirrored if one looks at pension wealth where the under 45’s own just 11% of pension wealth with the balancing 89% being owned by the over 45’s.

‘Tax efficient and secure – everyone benefits’

Two tax efficient savings options can be used for children.

- A Junior ISA (JISA) is available and the annual allowance is currently £4,368.

- A child’s pension is available even for a non-tax payer and tax relief will be granted on all personal contributions.

A net annual contribution of £2,880 made into a pension account for a child will, following a tax credit of £720.00, result in £3,600 being invested.

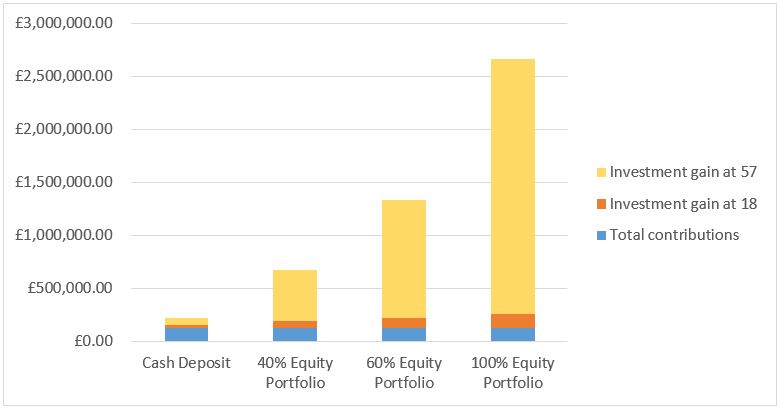

The following chart shows the benefit of compounding regular investment returns. The Citywide model portfolios are designed to capture global market returns tailored to your risk appetite and circumstances. The very long-term nature of these savings can support taking a higher level of risk and so allow you to maximise the opportunity for investment gain for your children or grandchildren.

The power of investing early is illustrated below. Simply by funding Junior ISA and pension contributions for the first 18 years of a young person’s life, that money, if invested in a conservative portfolio based on an expected return of 4.5% p.a., could achieve a fund of £1.2 million at age 57. Invested more aggressively, with an expected return of 6.0% p.a., the same amount invested could achieve a fund of £2.5 million.

By taking advantage of time and the compounding effects of capital market growth, together with our market leading investment philosophy, you have a powerful solution to build a significant asset for your children or grandchildren to access when they are older.

‘Can compound returns really make that much difference?’

The Rule of 70 is a quick way to estimate how long it will take for an asset to double based upon an annual rate of return. Divide 70 by the rate of return and you have the estimated number of years. For example, a 5% rate of return means that an asset will double in 14 years. A 1% return, such as that earned on deposit accounts would take a lifetime (70 years) to double.

‘What difference will this make for my children?’

The combination of the JISA and pension saving provides your children or grandchildren with two significant assets. The pension can be accessed from age 57 and as such will provide a level of comfort and security and a strong base for their retirement planning. Saving with the JISA and then continuing beyond age 18, there should be sufficient capital within the ISA to provide a good deposit for a first house purchase.

The capital in a JISA can be accessed at 18, and your child or grandchild will then have an ISA account which they, and you, can continue to contribute to. Contributions into the pension account can also continue as before.

Contact Citywide Financial Partners to find out more about how we can help you help your children and grandchildren.

Call us on 01372 365950 or email clinton.askew@citywidefinancial.co.uk

Past performance is not a reliable indicator of future performance. Investors should remember that the value of an investment and the income received from an investment can go down as well as up, and they may not get back the amount they invested.

Categories: Financial Planning, Investments, Security