Last year saw UK house prices reach an all-time high, increasing at the fastest rate in 15 years. Over 2021, the average price of a UK home went up almost £24,000 to reach £254,822 by the new year – that’s 16% more than in pre-pandemic 2020.

While this is good news if you already own a home or property portfolio, it’s not so positive for anyone looking to buy, especially for those just starting out.

What’s driving this trend?

With more people looking to buy and fewer houses to go around, demand is outstripping supply. When transactions are high and stock levels are low, this creates a seller’s market in which higher price demands are more easily met. Last year, a record 31% of homes sold for more than the original price tag.

There are many factors at play here, but the pandemic has been a significant driver of this dynamic in two key ways.

First, the race for space. For millions of people, spending months in lockdown has redefined the role a home plays in our lives. Now that the place you live in needs to function as a place you can work, rest and play in – a haven of productivity as well as entertainment and wellbeing – there’s increasing demand for more space and comfort. Out with the one-bed city apartment, in with the three-bed suburban semi or rural cottage. Or maybe even get that second home in the country…

That’s perhaps why London was 2021’s worst-performing region for sales growth (lower than 2020 at 4.2%), with Wales gaining the top spot (a 15.8% increase) for the first time ever.

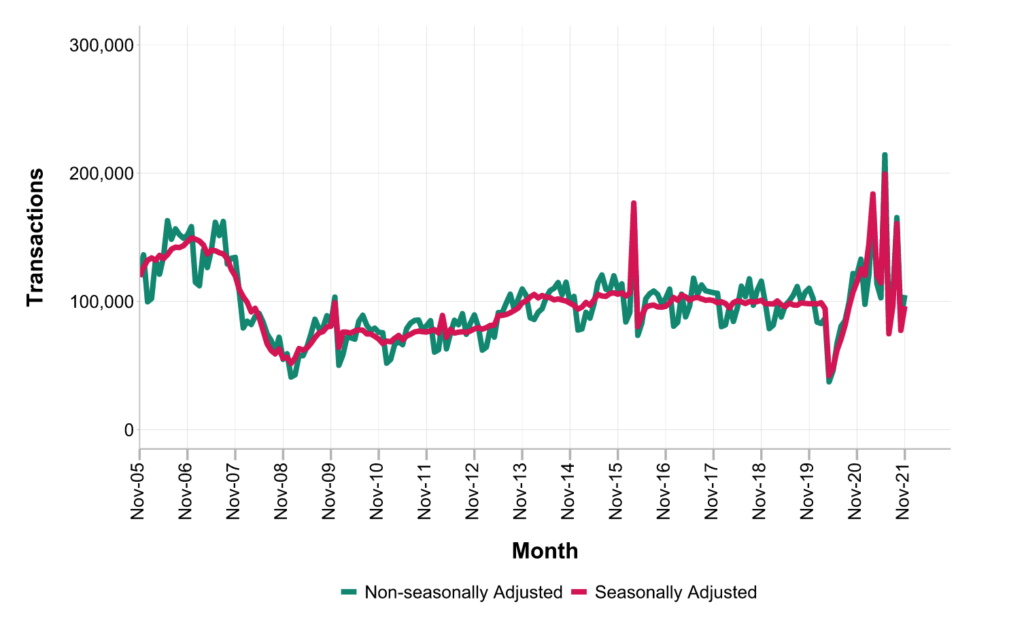

A second key contributor to high demand – translating into around 30% more sales in 2021 than in 2019 – is the stamp duty ‘holiday’. As part of its pandemic relief package, the UK government increased the tax-free threshold in England fourfold between July 2020 and September 2021, leaving zero tax payable on purchases up to £500,000 (previously £125,000). A similar, albeit less generous, measure also helped boost purchases in Scotland and Wales. Cue a mad rush to save thousands in tax before the gate closed, as shown in the spike of activity in HMRC’s chart below. The drop-off since then corresponds with renewed Covid restrictions towards the end of 2021.

Chart: UK residential property transactions between 2005 and 2021 (source: HMRC)

The problem of affordability

This level of growth is a difficult enough challenge for existing homeowners, but for those looking to take that first step, it’s less of a ladder and more of a mountain.

Today, a 20% deposit for an average UK home is equivalent to 110% of average earnings over the last year – the highest it’s ever been, and up 8% from the year before. Over in the capital, the average deposit of £88,000 translates to 183% of the average Londoner’s gross income.

The good news is that historically low interest rates have meant lower mortgages. However, as house prices have surged past earnings, it’s harder than ever to service that mortgage with your take-home pay.

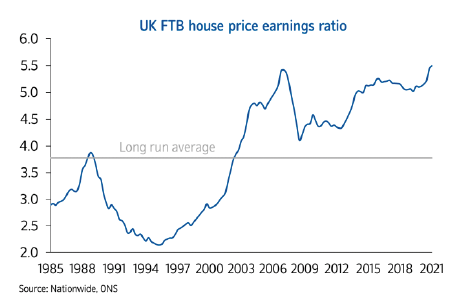

If you look at the ratio of house prices to income, it’s not a pretty sight, especially for those starting out. According to Nationwide’s UK first-time buyer house price to earnings ratio, it currently costs 5.5 times a first-time buyer’s typical annual income to buy a home. This is above 2007’s previous high of 5.4 and well above the long run average of 3.8. This varies regionally of course, with London’s number an eye-watering 9.0 and Scotland having the lowest at 3.4.

Graph: UK first-time buyer house price earnings ratio (source: Nationwide, ONS)

Obviously at these levels, buying a home is currently an unrealistic goal for many younger people. With today’s soaring inflation making life in general more expensive, income is already overstretched.

Perhaps it’s a form of generational reparation that more and more Millennials are relying on support from their Gen X and Baby Boomer families to get on the first rung of the ladder. In 2019/20, around a third of first-time buyers had some help raising a deposit through a gift or inheritance – 27% more than 25 years ago.

Will things ease up in 2022?

Now that stamp duty rates are back to normal, the working from home mandate has been lifted and interest rates and inflation are on the up, can we expect to see a calmer property market? Will prices and demand settle down now the rush is over and heads are clearer? Perhaps, although there’s no sign of a slow-down yet.

If you already own a UK home or property portfolio, the current landscape can be beneficial, boosting the value of your assets. But for first-time buyers and anyone looking to sell and buy in the same market, these will be difficult conditions.

If buying property – or helping a family member get on the ladder – is on your radar this year, good financial planning will be critical. At Citywide, we can help you work out where you stand and tailor a plan to meet your goals – property-related and beyond – to secure your family’s financial wellbeing. Just give us a call on 01372 365950 or send us a message to arrange a meeting.

Categories: Property