The inflation rates referenced in this blog were correct at the time of publication but are subject to change.

There’s no avoiding the headlines about rising inflation. Now that it’s reached over double the Bank of England’s target – hitting 4.2% in October – everyone’s likely to feel the pinch in one way or another.

It’s not just about the cost of milk, petrol and electricity. As Milton Friedman famously said, “Inflation is taxation without legislation”. With tax allowances frozen while your purchasing power takes a hit, this can have a potentially significant effect on your tax bill and overall finances over time.

The stealth tax raid

There may not have been much to bother most people in the Autumn Budget, but the groundwork had already been laid for increased tax bills in the long run. By freezing the main tax allowances and rate bands until 2026 back in March’s Spring Budget, what we’re facing is essentially tax increases by stealth over the next five years.

It’s a textbook case of fiscal drag. When tax bands don’t adjust as wages increase, this creates an artificially low threshold for higher income, pulling more and more people into liability for higher tax rates. As people’s income, capital gains, pensions and asset values grow over time, this harvests increasingly more revenue for HMRC.

So what can you do about it? The simplest defence is to make sure you make full use of all the available allowances and reliefs.

Income

The basic-rate income tax band in England, Wales and Northern Ireland is frozen at £12,570 with the higher-rate threshold set at £50,270 until at least April 2026. As a result, the Office for Budget Responsibility (OBR) estimates that an extra one million taxpayers will be sucked into the top 40% rate by 2026, netting an extra £13.9 billion for HMRC.

For anyone with a six-figure income, your personal allowance reduces by 50p for every pound by which your income exceeds £100,000. If this affects you, you may be able to make a pension contribution or a charitable gift to bring your income below £100,000.

Adding to the burden is the 1.25% increase in National Insurance contributions from April 2022. Taking into account OBR forecasts for wage growth and inflation, someone earning £80,000 is set to pay an extra £5,505 in tax over the next five years.

Short of rejecting any salary increases, unless you can benefit from a marriage allowance, there’s not much that employees can do about this one. If you have a workplace pension, however, you can decrease tax on your earned income through salary sacrifice arrangements with your employer. There may also be ways you can restructure other forms of income to reduce your future tax liability.

Savings and investments

The band of savings income you earn tax-free is stuck at £5,000 and the annual ISA subscription limit at £20,000, £9,000 for a Junior ISA. Use it or lose it!

The dividend annual allowance remains at £2,000, where it’s languished ever since it was cut from £5,000 in 2017. Dividend tax rates may still be lower than they are for income tax, but they’re set to increase by 1.25% across the board from April 2022 – creating a top rate of 39.35%. So it’s worth exploring your options to mitigate this extra burden before it comes into force.

Pensions

You can benefit from using your maximum annual allowance of £40,000. This may have been static since 2016, but you can carry over unused portions from the previous three years. This starts to taper if your ‘adjusted income’ is over £240,000.

Beware, however, that the pension lifetime allowance (LTA) – the amount you can hold in combined pension benefits before paying tax penalties – stopped tracking inflation in April. Now fixed at £1.073 million until 2026, if it had increased with inflation this year and 3.1% next April, it would be around £40,000 more. As pension funds increase in value, this will bring many more retirees in the firing line for 25% or 55% tax penalties each year.

The Treasury expects this to net them an extra £250 million. If you have a significant amount in pension benefits, it could be time for a review to help make sure you’re not one of the key contributors to HMRC’s coffers.

Inheritance tax

With the exemptions, allowances and reliefs here also frozen for the next five years, it’s prudent to explore your options to reduce the tax bill for your heirs if something happens to you. Stuck at the same level it’s been since 2009 – £325,000 per person – the tax-free ‘nil rate band’ allowance has already fallen well behind inflation. And while the residential nil rate band (RNRB) provides extra tax relief when passing a main home to direct descendants, £175,000 per person will not cover the value of most UK properties today.

How bad will inflation get?

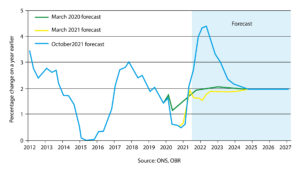

The unexpected pace of inflation over the last few months has prompted the government to rethink their forecasts. Already very close to the OBR’s projected 2022 inflation peak of 4.4%, the new Bank of England’s Chief Economist has now predicted it may go over 5% in the Spring.

Graph: Revised forecasts of CPI inflation from the Office for Budget Responsibility (OBR)

There are expectations that the rise will peak sometime next year before levelling out, albeit staying above the government’s target until 2024. So we need to prepare for higher inflation combined with tax increases – by stealth or otherwise – putting a squeeze on spending and income for a while yet.

This is a good time to think ahead and check you’re making the most of all the available allowances and tax-efficient opportunities for your savings and investments. If you’d like us to check your financial arrangements are structured in the most suitable way for today and what’s ahead, give us a call on 01372 365950.

Risk warnings

This article is distributed for educational purposes only and must not be considered to be investment advice or an offer of any security for sale. The reference to any products is made only to make educational points and must, in no circumstances, be deemed to be any form of product recommendation.

This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product.

Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Categories: Investments, Tax