‘Keep a clear head’ – it’s one of those instructions along with ‘stay calm’ that seems perfectly sensible and easy to achieve, until you’re in a situation that immediately requires it. If you run your own business then keeping a clear head won’t be new to you – nobody starts out as a success and every going concern experiences periods that are more stressful than others.

But you stick with it, you deal with the sleepless nights and you find ways to hold your nerve and come through. Being a business owner is nothing if not a way to develop resilience. The thing is, you need to show a similar spirit when it comes to your own finances, especially around investments, which can make even the most battle-hardened business owner question their own judgement.

Investment 101 – markets will do surprising things, it’s how you cope with those surprises that matters. In part six of our series on balancing your personal and business finances, here’s why it’s important.

Calm blue ocean

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. You need to keep raw, irrational emotion under control.” – Charlie Munger

Having a high IQ may be the traditional shorthand for intelligence, but it only deals with part of the picture. It looks at mathematical ability, problem-solving prowess and logic, but it doesn’t measure emotional intelligence for example, or fluid intelligence – the ability to assimilate information contrary to existing beliefs and adapt those beliefs to accommodate it.

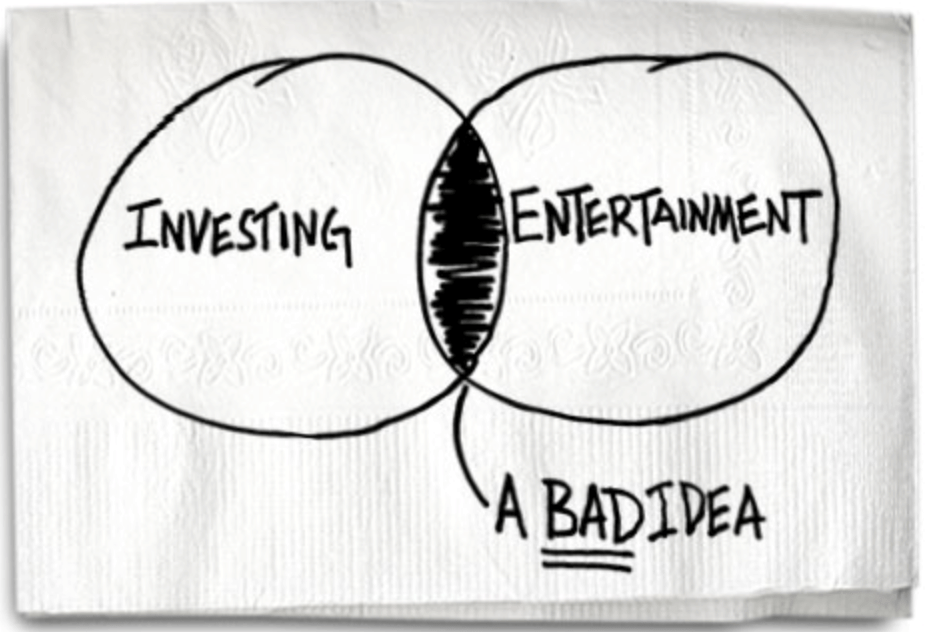

It also tells us nothing about how we react to stressful situations. We may flatter ourselves that we’re gifted with detached judgement required to make smart investment decisions, but the reality is that our emotions will creep into it, and we may not even be aware that we’re acting on emotions. Remember that investing isn’t a jolly – it’s not a flutter on the horses or a round of poker. Investing is about planning the right approach and sticking to it.

Keep your cool

Even if you’re being as serious as serious can be, it’s not always easy to keep a cool head, because we’re all saddled with certain hard-wired behavioural biases. They’re the instinctive reactions and mechanisms for coping with the world that help us to get through life without being permanently distracted or terrified of failure. When it comes to investing though, they frequently cloud our judgement.

For example, a downturn in the markets can be scary and it can cause us to panic and pile into, or out of, particular assets or sectors when that may not be the best course of action. We can’t get rid of our biases, but we can learn to identify and control them, to take a step back when there’s a temptation to go with the knee-jerk reaction.

Volatility is to be expected, but investing is a long-term pursuit and it’s important to understand that risk has more than one face. You need to be just as aware of the risks of not putting your money to good use and not being able to achieve the goals you’ve set for yourself.

Where Citywide can help

At Citywide we’ve built our reputation on the close bonds we build with our clients. We ask the right questions, so we know who you are before we start telling you what’s best for your money and your future.

But we’re also here to help guide you through the unfamiliar. We’ve seen markets move in all directions and we’ve also seen that in the end, sticking to the plan is what pays off. It’s not easy to do in the heat of the moment, so we’ll help you to manage your investments in a rational, sensible way that helps you to meet the goals you’ve set for yourself.

If you’ve enjoyed reading this part of our guide to keeping your personal and business finances in shape, you can download our full guide, 10 actions successful business owners take to grow their personal wealth, today.

Download our full guide here

If you’d rather read them one at a time, we’ll be posting all our tips for running a tight ship at home and at work in the coming weeks, or you can opt in to email updates.

Risk warnings

This article is distributed for educational purposes only and must not be considered to be investment advice or an offer of any security for sale. The reference to any products is made only to make educational points and must, in no circumstances, be deemed to be any form of product recommendation.

This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product.

Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Categories: Business Owners, Financial Planning, Investments, Wealth Management