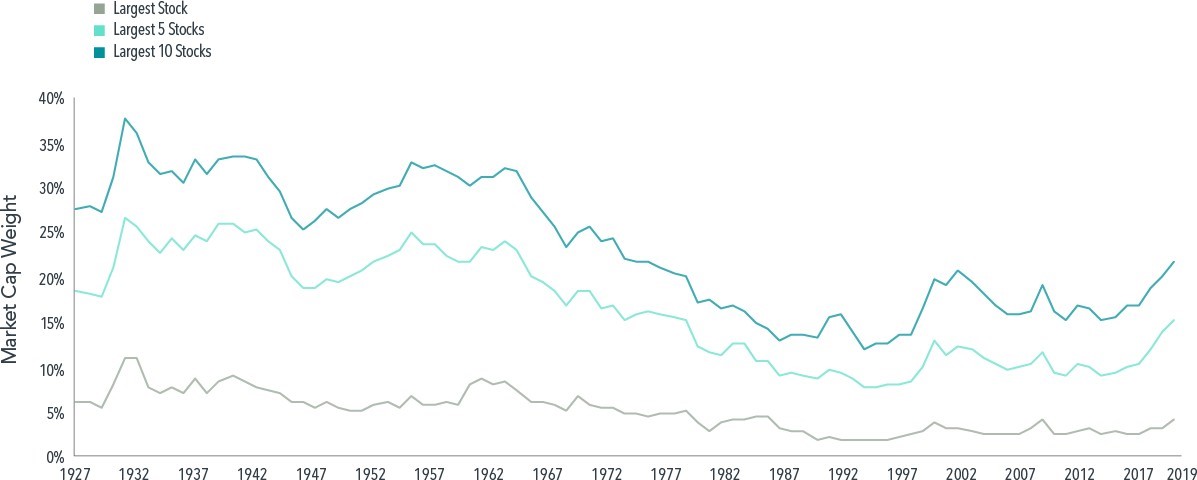

A top-heavy stock market with the largest 10 stocks accounting for over 20% of market capitalization and a technology firm perched at No.1? This sounds like a description of the current US stock market, dominated by Apple and other tech stocks but it is actually a reference to 1967, when IBM represented a larger portion of the market than Apple at the end of 2019 (5.8% vs. 4.1%).

As we see in Exhibit 1, it is not particularly unusual for the market to be concentrated in a handful of stocks. The combined market capitalisation weight of the 10 largest stocks, just over 20% at the end of last year, has been higher in the past.

Exhibit 1

Same Old Story

Weight of largest stocks by market capitalization in US stock market, 1927–2019

Source: Dimensional, using data from CRSP and Compustat. Includes all US common stocks. Largest stocks identified at the end of each calendar year by sorting stocks on market capitalization. CRSP and Compustat data provided by the Center for Research in Security Prices, University of Chicago.

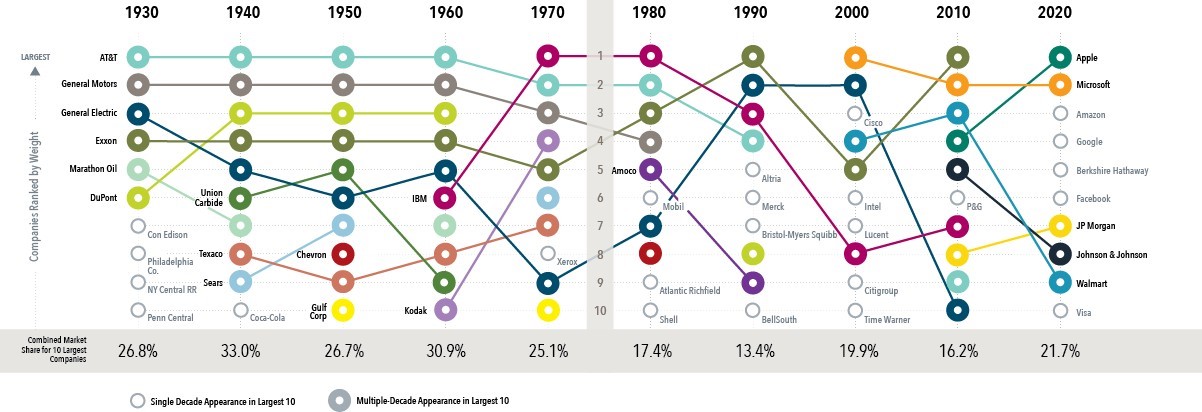

A breakdown of the largest US stocks by decade in Exhibit 2 shows some companies have stayed on top for a long time. AT&T was among the largest two for six straight decades beginning in 1930. General Motors and General Electric ranked in the top 10 at the start of multiple decades. IBM and Exxon were also mainstays in the second half of the 20th century. Hence, concentration of the stock market in a few large companies such as the FAANG stocks in recent years is not a new normal; it is old normal.

Exhibit 2

Big Board

Largest 10 US stocks at the start of each decade

Source: Dimensional, using data from CRSP and Compustat. Includes all US common stocks. Largest stocks identified at the end of the calendar year preceding the respective decade by sorting eligible US stocks on market capitalization using data provided by the Center for Research in Security Prices, University of Chicago.

Moreover, while the definition of “high-tech” is constantly evolving, firms dominating the market have often been on the cutting edge of technology. AT&T offered the first mobile telephone service in 1946. General Motors pioneered such innovations as the electric car starter, airbags, and the automatic transmission. General Electric built upon the original Edison light bulb invention, contributing to further breakthroughs in lighting technology, such as the fluorescent bulb, halogen bulb, and the LED. So technological innovation dominating the stock market is not a new normal; it is an old normal too.

Another trend attributed to a new normal is the extraordinary performance of technology stocks over the past decade, leading some to wonder if we should expect these stocks to continue such strong performance going forward. Investors should remember that any expectations about the future operational performance of a firm are already reflected in its current price. While positive developments for the company that exceed current expectations may lead to further appreciation of its stock price, those unexpected changes are not predictable.

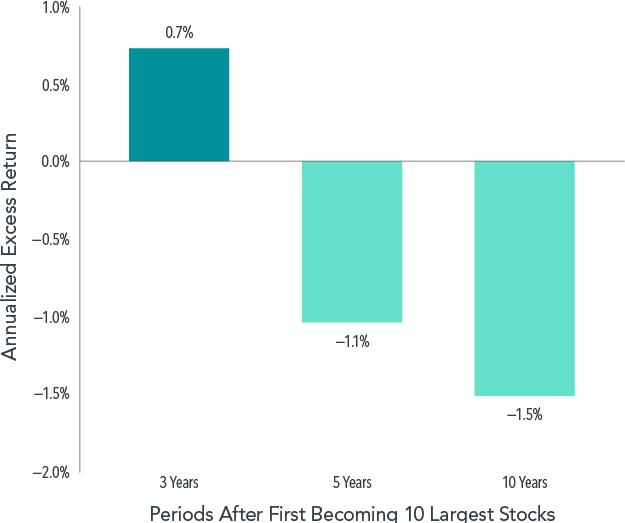

To this point, charting the performance of stocks following the year they joined the list of the 10 largest firms shows decidedly less stratospheric results. On average, these stocks outperformed the market by an annualized 0.7% in the subsequent three-year period.

Over five- and 10-year periods, these stocks underperformed the market on average.

Exhibit 3

Power Down

Annualized return in excess of market for stocks after joining list of 10 largest US stocks, 1927–2019

Past performance is not a guarantee of future results.

Source: Dimensional, using data from CRSP and Compustat. Includes all US common stocks. Largest stocks identified at the end of each calendar year by sorting eligible US stocks on market capitalization using data from CRSP. Market is represented by the Fama/French Total US Market Research Index. Excess return for each stock is the difference in annualized compound returns between the stock and the market, computed from the first month following initial classification in the top 10. Stocks in the sample are required to have at least 36 months of returns data following classification in the top 10.

The only constant is change, and the more things change the more they stay the same. This seems an apt description of the dominant stocks atop the market. While the types of businesses most prominent in the market vary through time, the fact that a small subset of companies’ stocks account for an outsized portion of the stock market is not new. And it remains impossible to systematically predict which large companies will outperform the stock market and which will underperform it. This underscores the importance of having a broadly diversified equity portfolio that provides exposure to a vast array of companies and sectors.

GLOSSARY

Fama/French Total US Market Research Index: The value-weighed US market index is constructed every month, using all issues listed on the NYSE, AMEX, or Nasdaq with available outstanding shares and valid prices for that month and the month before. Exclusions: American depositary receipts. Sources: CRSP for value-weighted US market return.

Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio is rebalanced.

Risk warnings

This article is distributed for educational purposes only and must not be considered to be investment advice or an offer of any security for sale. The reference to any products is made only to make educational points and must, in no circumstances, be deemed to be any form of product recommendation.

This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product.

Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Categories: Financial Planning, Investments