As we start to experience the effects of the coronavirus pandemic, we’re all reeling from Covid-19 news overload. One moment we’re being told to panic about rising numbers of cases, then the stock markets, then other countries, then back to us, then to new legislation, and back around again. It’s a stressful, turbulent time filled with uncertainty and upheaval, and it’s likely you’re not feeling yourself. That’s okay – hardly anybody is. The resulting ‘pandemic anxiety’ is new to all of us. You’re not alone in this.

Pandemic anxiety

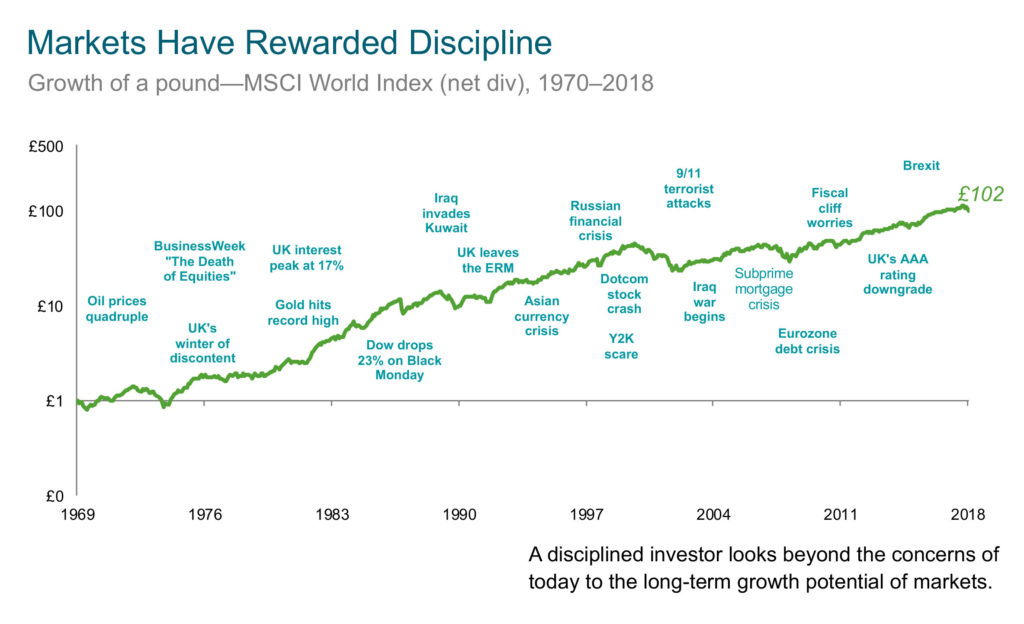

It’s likely that part of this anxiety will be directed towards your finances as the stock market reacts to the news. I have been in the Financial Services sector for 38 years. In that time I’ve seen through several market crashes; Black Monday of 1987, the early 1990s recession, the Dot-com bubble, 9/11 market shakes, and the 2007-2008 Financial Crisis, to name a few. The key thing I’ve learned through these ups and downs is that staying in the market is key. React to these challenges with your head, not your heart. Avoid the knee-jerk instinct to take your money out of the market immediately. Let it be. Successful wealth management involves long-term planning from the very start, and you will get nowhere by reacting to short-term market corrections.

The chart below showing the growth of an investment from 1970-2018 illustrates this commitment to the long-term perfectly; despite everything that has happened along the way, its growth has remained steady.

The second key thing I’ve learned about navigating these financial crises is that it’s natural to feel anxious and overwhelmed. While it’s natural to feel emotional and overwhelmed, my advice would be to not make any big snap decisions that may ultimately be unhelpful.

Right now, our ‘pandemic anxiety’ is a stressful mix of family, health and financial worries. Combined with a lack of control over the situation, this has the potential to be a toxic mix.

But that’s fine – in times of crisis, it’s natural that our behaviours take a hit. As with past financial crises, everything feels worse in the moment than it seems in retrospect.

Reduce the stress: create wellbeing

In this situation it’s extremely difficult to make big decisions with clarity. As investors, this is the risky time where you may start to worry and overthink your portfolio, or make a big decision rashly. As a human, this is where you may struggle with basic decisions like ‘what’s for dinner?’. We need to focus on physical, mental and financial wellbeing. Luckily there are some proven exercises you can work through to consciously reign in stress and anxiety. You should do these daily while we’re working through this difficult time.

Breathe

Of all the physical reactions that stress triggers, breathing is the only one you have conscious control over. Regulating your breathing will in turn assist your body with understanding that there is no physical threat, and it will start to dial back the adrenaline and cortisol rush. Here’s one to try:

Box Breathing

- Box breathing is about slow, deep breaths for four equal counts. It’s a classic anxiety-relieving method.

- Start by exhaling deeply. Focus hard on pushing as much air from your lungs as you can.

- Inhale slowly through the nose for a slow count of four.

- Hold the breath for another, equal count of four.

- Exhale slowly through the mouth for the same count of four.

- Hold here for one last equal count of four.

- Repeat four times in total.

Call a friend

Quarantine and social distancing are lonely endeavours, no matter how important they are. Pick up the phone and call a friend or family member. Laugh together – laughter releases endorphins, which are a natural pick-me-up. Just because we’re distancing physically doesn’t mean not speaking! There are lots of new things you can try online too. We’ve been trying a book club, a pub meet, travel photo sharing and lectures all on Zoom.

Do something with your hands

Choose something low-stress, but which holds your focus. Try cooking a new recipe, or drawing, or organising your bottle cap collection. Satisfying, and keeps you busy and grounded.

Move your body

Now more than ever it’s important to look after body and mind equally. Take your daily walk, feel the spring sun on your face, stretch.

Step away from the news

If you’ve been thinking about taking a social media hiatus in your personal life, now is the time to do it. Constant news cycles reporting on the pandemic help nobody’s state of mental wellbeing – all it will do is scare you. Keep up to date with reliable sources, such as the BBC and the NHS website, but block out the noise on social channels.

Be kind

To yourself, to your family and friends, to the key workers in our supermarkets and the NHS, to your pets (who we’re sure are loving all the attention they’re getting right now!). Now is not the time to go on a diet or start a huge new project or try to learn an ambitious new skill. If you feel in the right mindset for that, then more power to you, but for the majority of people right now things are stressful enough as they are. In this ‘pandemic anxiety’ mindset, you’ll likely struggle to concentrate and end up even more frustrated than you were when you started. Now is the time for creature comforts and being gentle with ourselves and those around us.

In our last blog we spoke about The Change Curve. Right now, we’re all at the very beginning, in shock, denial, and frustration. As we move from the initial upheaval and re-adapting phase, we will slowly come out into a renewed, positive view. Until then, the best things you can do are look after yourself, and leave your investments be.

Risk warnings

This article is distributed for educational purposes only and must not be considered to be investment advice or an offer of any security for sale. The reference to any products is made only to make educational points and must, in no circumstances, be deemed to be any form of product recommendation.

This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product.

Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Categories: Investments, Markets