Over the next two decades, what is anticipated as the largest intergenerational wealth move in history is set to occur. Dubbed “The great wealth transfer”, this handover of financial assets from the Baby Boomer generation to their Gen X and Millennial heirs is expected to exceed £6.5 trillion in the UK by 2045. Several factors are driving this transfer such as an ageing population, increased wealth concentration and longer life expectancies, however, it is set to reshape the economic landscape in the UK.

There is a famous quote from Germany’s first-ever chancellor Otto von Bismarck: “The first generation earns the money, the second manages the wealth, the third studies history of art, and the fourth degenerates completely.” Although this may be a little extreme, research suggests that 70% of wealthy families lose their wealth by the second generation and 90% will lose it by the 3rd generation. This great wealth transfer will therefore present both opportunities and challenges for those involved and manging this newfound wealth for the new generations requires careful planning and financial literacy.

At Citywide, our business is built around our client families. In some cases, this spans over three generations, and puts Citywide in an ideal position to not only be able to provide help, education and guidance to younger members of the family through our introduction to investing sessions and our newly launched Investment Success Programme (ISP) but also helping to ensure that older clients are able to set up appropriate provisions for passing their wealth on in the most tax efficient way.

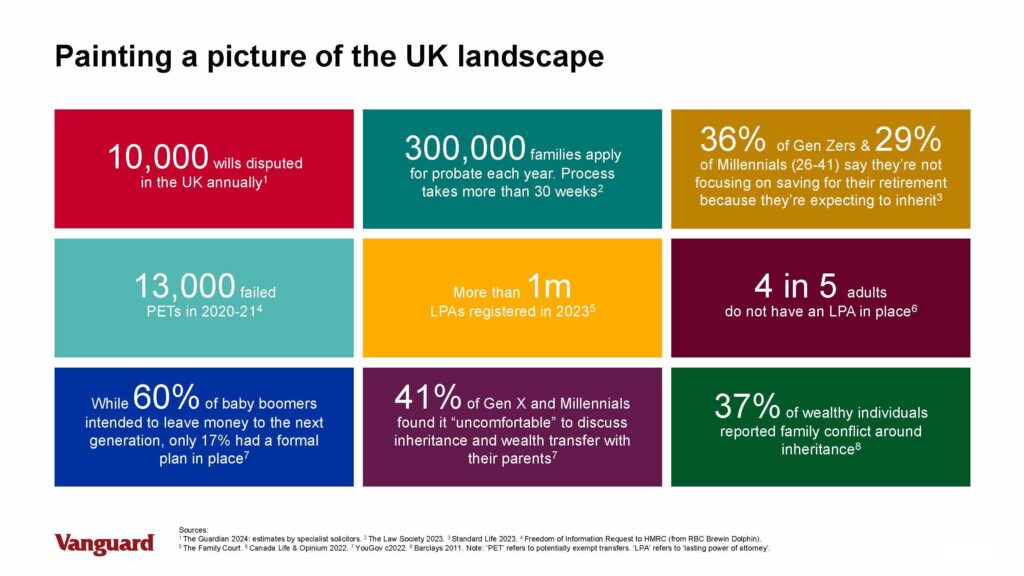

Family dynamics are often complex and so this subject, which can often feel morbid and uncomfortable, becomes easier to push off into the future. However, putting concrete plans in place sooner rather than later is often the best course of action. These steps can start small with education for the younger generations, making use of smaller annual gifting allowances, before moving on to deeper planning and larger gifting plans.

By fostering open communication, leveraging technology, and prioritising education, families can ensure a smooth transition of wealth and preserve their financial legacies for generations to come. As a valued client at Citywide, we encourage you to begin these discussions about your legacy goals with us and your family. We are here to support you to build a solid foundation for the future.

To get started, consider the following seven questions designed to assess how well-prepared you are to ensure your loved ones are in the best possible position if the unexpected happens.:

- Do you have a valid and up to date will?

- Do you have valid and up to date Lasting Powers of Attorney (LPA)?

- Do you have a certified copy of your LPAs readily available?

- Can your next of kin access your digital life? This includes managing social media accounts or keeping track of online banking.

- Can your next of kin access your phone?

- Has your next of kin/executors/attorneys met your financial planner?

- Have you shared your wishes with your family?

If the answer isn’t yes to all the above, then this could be a great place to start to try and alleviate some of the potentially stressful situations your loved ones may find themselves in. Give us a call to find out more.

written by Matt Burt, Financial Planner

Categories: Financial Planning, Investments